This can lead to financial misstatements due to intentional fraud or accidental errors. An accounts payable audit is an independent assessment of financial data from an organizations accounts payable records.

(102).jpg)

Auditing Final Multiple Choice Proprofs Quiz

Audit Procedures for Accounts Payable.

. Other reliable external evidence to support the balances is likely to be available. RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial the use of confirmations would. Auditors may choose not to confirm accounts payable because.

Confirmation obtains evidence identical to that obtained by cutoff tests. The auditors claim that the amount was not material but because the sample size was so small they could not make an accurate judgement. A reading of the corporate minutes reveals that confirmation is unnecessary.

Without proper internal controls things like unrecorded liabilities expense fraud and duplicate payment could happen at any time in businesses big and small. To audit accounts payable you must match the ledger transactions to the figures in your general ledger. Auditor confirmation of accounts payable balances at the balance sheet date may not need to be performed by the auditor because.

SOX audit requirements are different than those for other Accounts Payable audits focusing more heavily on your data protection measures than your AP methodology. While routine Accounts Payable audits can be performed by an internal auditor youll need to hire an independent auditor for a Sarbanes Oxley review. C accounts payable balances at the balance sheet date may not be paid before the audit is completed.

Unethical behavior means the client may reduce the accounts payables balance by different means to window dress the figures of the balance sheet for bright financials. Nevertheless and despite an auditing procedure study peer reviews continue to find that CPA firms have problems understanding the various processes. A This is a duplication of cutoff tests b Accounts payable balances at the balance sheet date may not be paid before the audit is completed c Correspondence with the audit clients attorney will reveal all legal action by vendors for nonpayment.

Disclose the fact that alternative procedures were used due to client imposed restrictions. Confirmation obtains evidence identical to that obtained by cutoff tests. Confirmation obtains evidence identical to that obtained by cutoff tests.

Hence in substantive procedures to gather audit evidence on accounts payable we usually place our attention more on the area that exposes to. Other reliable external evidence to support the balances is likely to be available. It examines how AP transactions are being recorded and if it represents an accurate view of your business operations.

To confirm accounts payable because. A reading of the corporate minutes reveals that confirmation is unnecessary. In many audits the main focus is your accounts payable department.

An accounts payable audit is an independent assessment of financial data from an organizations accounts payable records. Auditors may choose not to confirm accounts payable because. Auditor confirmation of accounts payable balances at the balance sheet date may be unnecessary because.

Cutoff tests check to whether transactions for the fiscal year are indeed included in your business end of year financial statements. Auditors may choose not to confirm accounts payable because. Confirmation obtains evidence identical to that obtained by cutoff tests.

A this is a duplication of cutoff tests. It examines how AP transactions are being recorded and if it represents an accurate view of your business operations. Confirmation obtains evidence identical to that obtained by cutoff tests.

Auditors may choose not to confirm accounts payable because Other reliable external evidence to support the balances in likely to be available The assertion most directly addressed when performing the search for unrecorded liabilities is. Auditors may choose. Usually our main concern regarding the misstatement that could occur on accounts payable is the understatement of accounts payable as the fewer liabilities the company has the better it looks.

A reading of the corporate minutes reveals that confirmation is unnecessary. Other reliable external evidence to support the balances is likely to be available. Other reliable external evidence to support the balances is likely to be available.

Accounts payable can be a particularly high-risk item to audit because of its subjectivity. B there is likely to be other reliable external evidence available to support the balances. AICPA STANDARDS CLEARLY STATE procedures for confirmation of accounts receivable.

Asked Jul 13 2018 in Business by NightOwl. Fraud may result because of personal perks such as acquiring supplies for higher prices than the original price of the material and then claiming back those perks from vendors. Accounts payable is an important area of your business to audit because of risk.

Auditors may choose not to confirm accounts payable because. The second problem occurred when the auditor accepted phone confirmations and internally generated documents such as cash receipts to confirm that the sample material was correct. In many audits the main focus is your accounts payable department.

Auditors may choose not to confirm accounts payable because other reliable external evidence to support the A printer needs to make a poster that will have a total of 500 cm2 that will have 3 cm margins on the sides and 2 cm margins on the top and bottom. Question 4 If the auditor obtains sufficient evidence on a clients accounts receivable balance through alternative procedures because it is impractical to confirm accounts receivables the auditors opinion should be unqualified and could expect to. Other reliable external evidence to support the balances is likely to be available.

How To Effectively Audit Your Accounts Payable Department Corcentric

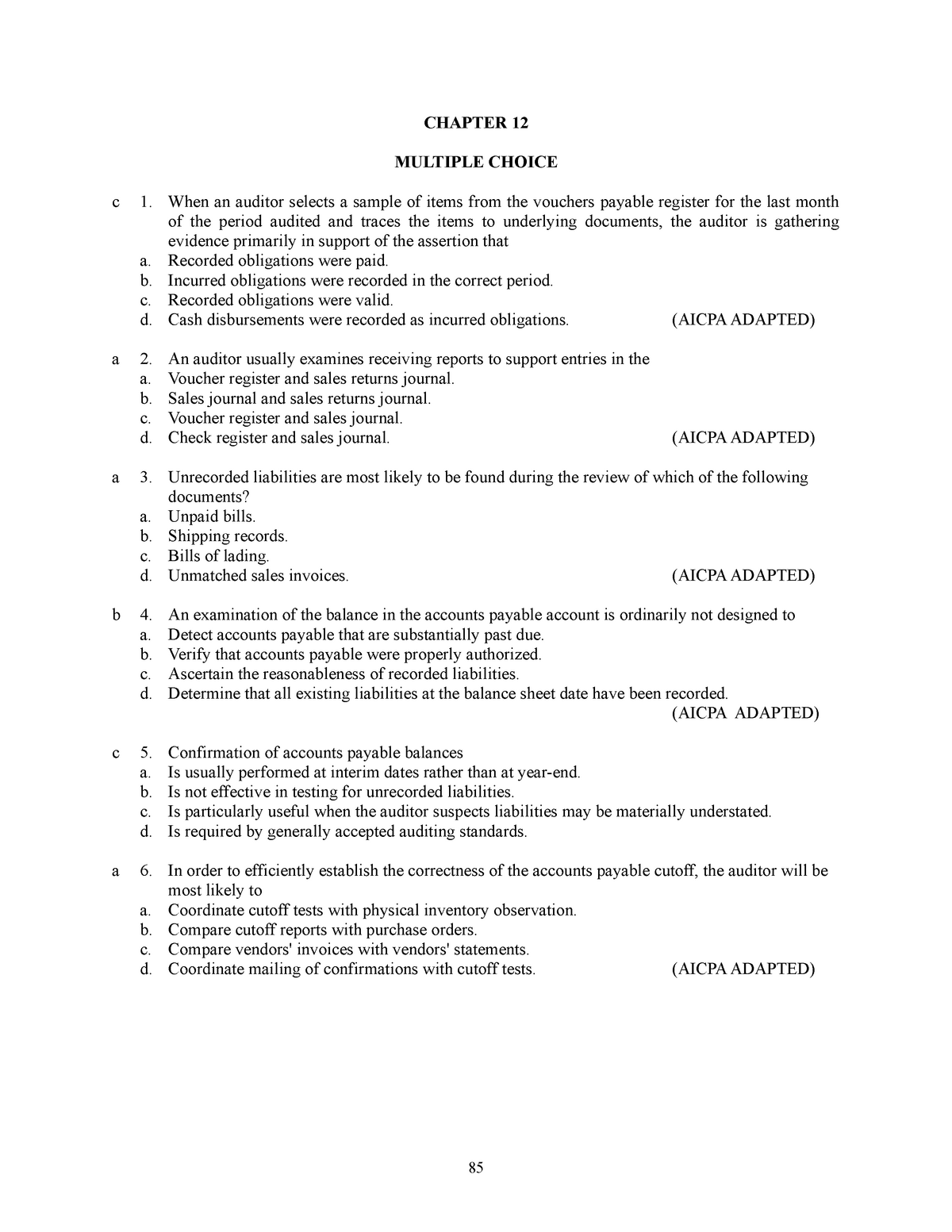

Exam 14 February 2020 Questions And Answers Chapter 12 Multiple Choice C 1 When An Auditor Studocu

0 Comments